Our Strategy

Our ambition is to be the pre-eminent integrated brands and drinks distribution business serving the UK and Ireland drinks markets

- Provide a range of local and core brands, premium, craft and third-party brands that is unrivalled.

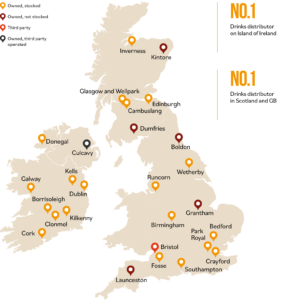

- Our distribution infrastructure provides market leading national scale, reach and efficiencies.

- These brands and asset base are underpinned by our offer: dedicated and passionate people; enhanced customer service; market insight and value.

- The Group has sustainability at its core – with the target of delivering to a better world.

| Strategic Pillars | Invest and grow our portfolio of leading local, premium and craft beer and cider brands. | Strengthen our position as the No.1 drinks distribution platform in the UK and Ireland. | Capital allocation to enhance growth and shareholder returns. |

|---|---|---|---|

| Medium Term strategic goals |

|

|

|

| Measurement |

|

|

|

| Achievements during FY2022 | Link to Strategic Pillars |

|---|---|

| Invest and grow our portfolio of leading local, premium and craft beer and cider brands. |

| Strengthen our position as the No.1 drinks distribution business in the UK and Ireland. |

| Capital allocation to enhance growth and shareholder returns. |

Our core strategic objective is to deliver earnings growth.

Existing Businesses

- Create an environment that ensures the health and safety of our colleagues. Further, establish a business culture that nurtures engaged, inspired and committed colleagues, investing in key capabilities for the future

- Grow and strengthen our portfolio: growing cider share and building momentum in our premium beer portfolio as consumer preferences evolve

- Leverage our scale and reach to drive operational efficiencies in our distribution infrastructure, optimising our capacity and ensure a market leading cost to serve

- Drive better customer service through our C&C GB change programme with a simplified and integrated approach which will enhance customer experience and ultimately drive efficiencies into our back office

- Enhance our offer: commercialising the data and insight that is available; continuing to develop our ecommerce offering; and building stronger partnerships with ‘equity for growth’ investments or complimentary agencies

Capital Allocation

- Maintain the strong cash conversion characteristics of the business

- Deleverage the balance sheet, targeting a medium-term target of less than 2.0x Net Debt/EBITDA

- Invest in our brands; review inorganic opportunities and return excess capital to shareholders

Environmental, Social and Governance

- Execute a credible sustainability strategy focussed on people and planet